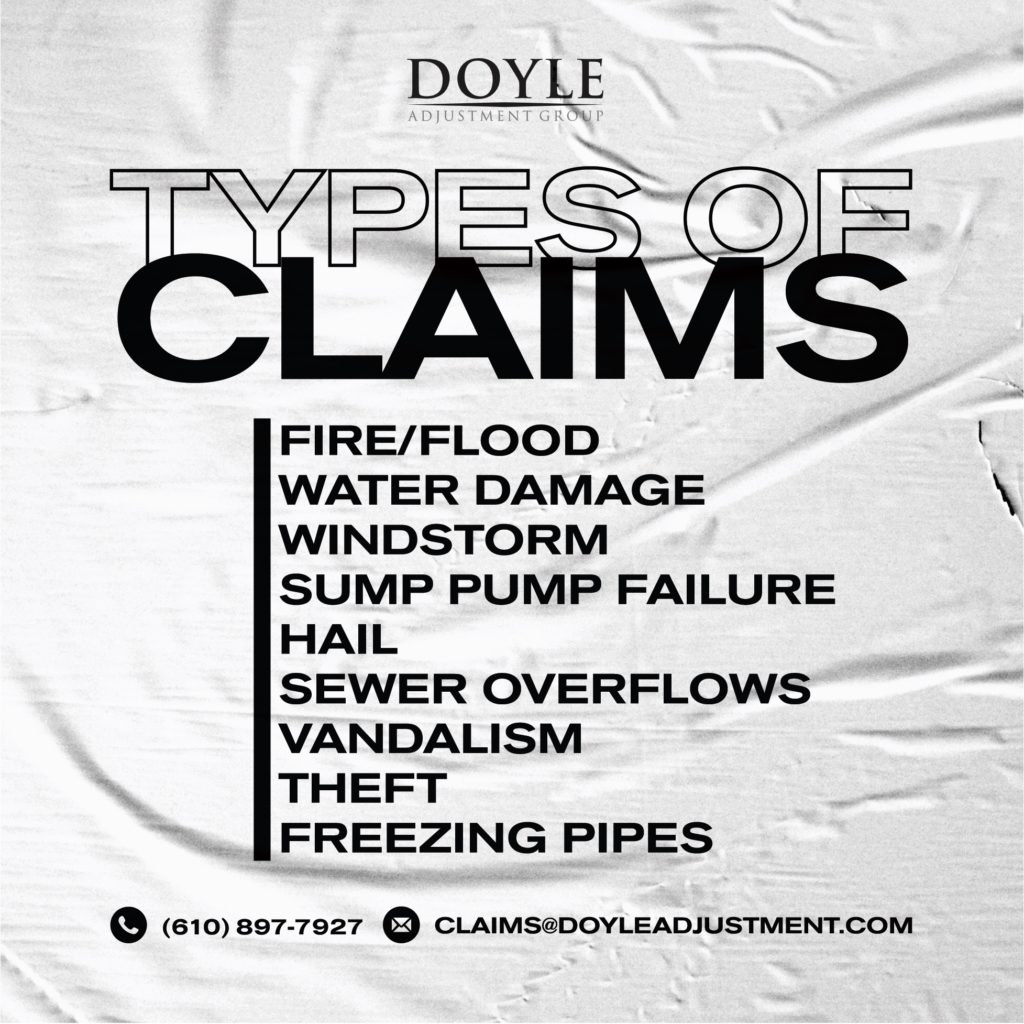

Has your claim been denied? Did you receive a settlement on your claim that you are not happy with?

Reopen My Claim! We at the Doyle Adjustment Group can reopen your insurance claim even if you’ve already been paid. We enjoy reopening claims because it’s one of the best opportunities for our firm to prove our value and expertise.

Typically we reopen insurance claims and get paid above and beyond what you have already received from your carrier. If we don’t recover more money, then we don’t get paid.

Reopen My Claim: The Process

Have you filed your claim, received a smaller-than-sufficient settlement check, and are not happy? You don’t know where to turn and are tired of chasing down an adjuster who won’t return your calls?

The insurance adjuster’s job is to minimize your loss. They are professionally trained by the insurance carrier to pay you as little as possible, while at the same time, making you feel like you received a fair offer.

Let us at the Doyle Adjustment Group show you the value of hiring a professional public adjuster. When we reopen your claim, we will only take a fee on the money we recover. When you utilize our services, we will send a letter of representation to your adjuster. Next, we perform a thorough inspection of the damage to your home or business with our licensed adjusters.

Once we have completed our estimate, we will then schedule a re-inspection with your adjuster to revisit items that were not covered in the initial inspection.

In most cases, the insured will see a significant increase in the value of their claim. However, there are times when other measures are needed to obtain a fair and equitable settlement. This process is called an Appraisal.

How does the Insurance Appraisal Process Work?

The appraisal language in a HO3 policy typically reads:

Appraisal: If you and we fail to agree on the actual cash value, amount of loss, or cost of repair or replacement, either can make a written demand for appraisal. Each will then select a competent, independent, appraiser and notify the other of the appraiser’s identity within 20 days of receipt of the written demand.

The two appraisers will choose an umpire. If they cannot agree upon an umpire within 15 days, you or we may request that the choice be made by a judge of a district court of a judicial district where the loss occurred. The two appraisers will then set the amount of loss, stating separately the actual cash value and loss to each item.

Once the Appraisal clause/provision is invoked, the insured’s appraiser and the insurance carrier’s appraiser will estimate the damage and try to agree on the amount of loss.

If the appraisers fail to agree, they will submit their differences to the umpire. An itemized decision agreed to, by two of these three will set the amount of loss. Such an award shall be binding.

Each party will pay its appraiser and bear the other expenses of the appraisal and umpire equally.

Policyholders whose insurance claims have been settled:

Even though your case has been settled, you may still qualify for extra compensation. Insurance agencies customarily neglect to appropriately decide the degree of damages that need to be addressed in a claim, causing significantly lower estimates to complete the repairs.

Most states have policyholder protection laws that permit you to re−open a claim if you were not completely compensated.

- Most states permit you to re-open a case as long as 1 year after the damages occurred.

- Regardless of payment, you can re-open the case for additional compensation.

- We will review your case If you feel that you didn’t get a reasonable settlement.

- Your offer may be founded only on what is seen during an initial inspection of the premises. Commonly there are hidden problems found during the repair process.

You even have the right to compensation for extra expenses caused during development, for example:

- License costs

- Building charges

- Code Upgrades

- Electrical Usage

- Cleaning